Annuities Questions And Answers Pdf

As well as from most pensions and annuities are treated as taxable income. Pursuant to Notice 2021-21 IRA contributions for the 2020 tax year have been extended from April 15 2021 to May 17 2021.

Ordinary Annuity Vs Annuity Due Youtube

To send your quote to an agent complete these steps.

Annuities questions and answers pdf. Access the answers to hundreds of Annuity questions that are explained in a way thats easy for you to understand. Immediate and deferred classifications indicate when annuity payments will start. Refer to IRS Publication 17 for a more detailed coverage of gross income items and what is considered to be taxable for your particular situation.

This exemption does not apply to civil service pensions or annuities even if the pension or annuity is based on credit for military service. Underlying fund fees also apply. Complete the information on the Customize Policy page or review the Your Quote Summary screen.

6th Grade Language Arts Worksheets. John Hancock Variable Annuities are distributed by John Hancock Distributors LLC. California law requires Life-Only agents to complete eight hours of California specific annuities training prior to soliciting individual customers in order to sell annuities.

Locate Get a quote for term life insurance at the top of this page. In juxtaposition thereto to the effect that issuance of the policy may depend upon the answers to the health questions set forth in. Typically these annuities are funded with money from 401ks or other tax-deferred retirement accounts such as IRAs.

Addition of numbers worksheet rocket lesson plans grid chart paper christmas puzzles to print adding decimals games printable free pre k math worksheets math. While submission of the documentation mentioned above meets the verification. IRS Form 5498 Questions and Answers Important.

Its important to consider your income goals risk tolerance and payout options when deciding which type of annuity is. This page provides answers to frequently asked questions about verification issues for the second round of the 2009 negotiated rulemaking activities for higher education. In the State field select your state from the drop-down list and click Go.

The main types of annuities are fixed annuities fixed indexed annuities and variable annuities. Complete all of the information for the Life Insurance Quote page and click Get Quote. Get help with your Annuity homework.

In New York John Hancock Annuities are issued by John Hancock Life Insurance Company of New York Valhalla NY 10595. Military Personnel and Families New Jersey PensionRetirement Exclusion Even if you have taxable income from a pension annuity or IRA y ou may be able to exclude all or. 1 Advertisement means material designed to create public interest in life insurance or annuities or in an insurer or in an insurance producer.

6th Grade Reading Comprehension Worksheets. When you receive payments from a qualified annuity those payments are fully taxable as income. Section 2202 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 provides for special distribution options and rollover rules for retirement plans and IRAs and expands permissible loans from certain retirement plans.

John Hancock Annuities are issued by John Hancock Life Insurance Company USA Lansing MI 48906 which is not licensed in New York. 6th Grade Grammar Worksheets. 6th Grade Social Studies Worksheets.

Estimate income from pensions and annuities IRA and 401k distributions and Social Security income using prior year taxable amounts. Or to induce the public to purchase increase modify. According to 123119 data on non-group open variable annuities from Morningstar Inc at 025 Fidelity Personal Retirement Annuitys annual annuity charge is significantly lower than the national industry average 111 annual annuity charge.

In addition if a Life-Only Agent sells an annuity product in a subsequent license term the agent must complete a four-hour California specific annuity training course. 4th Grade Language Arts Worksheets. If an annuity is funded with money on which no taxes have been previously paid then its considered a qualified annuity.

Annuity Questions and Answers.

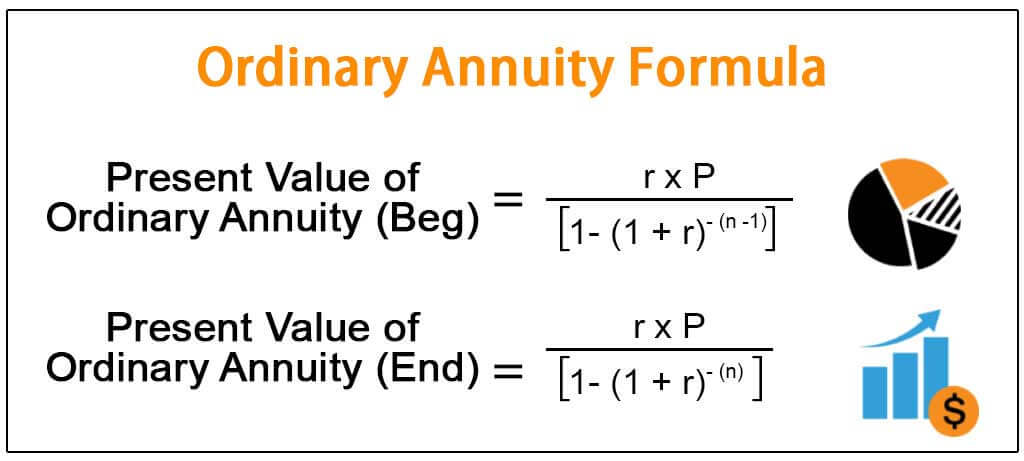

Ordinary Annuity Formula Step By Step Calculation

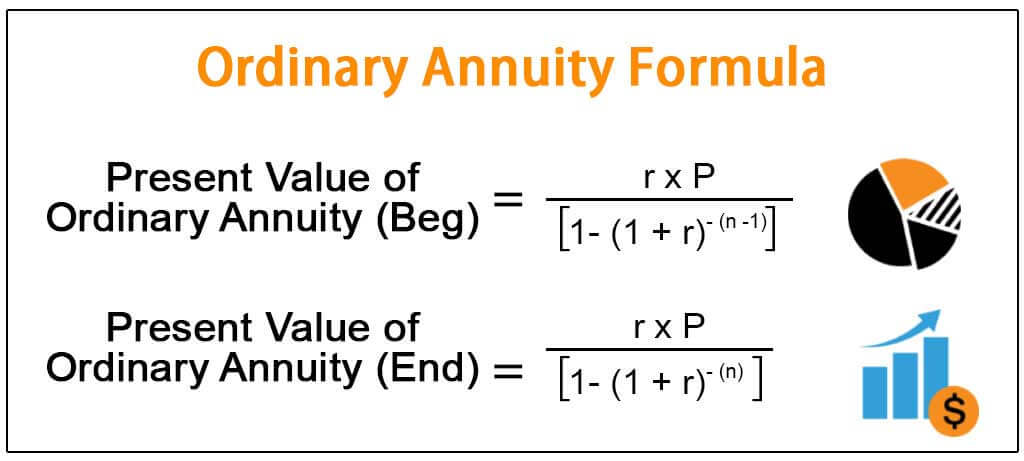

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Annuity Contract For Cash Inflows Outflows Example Calculationss

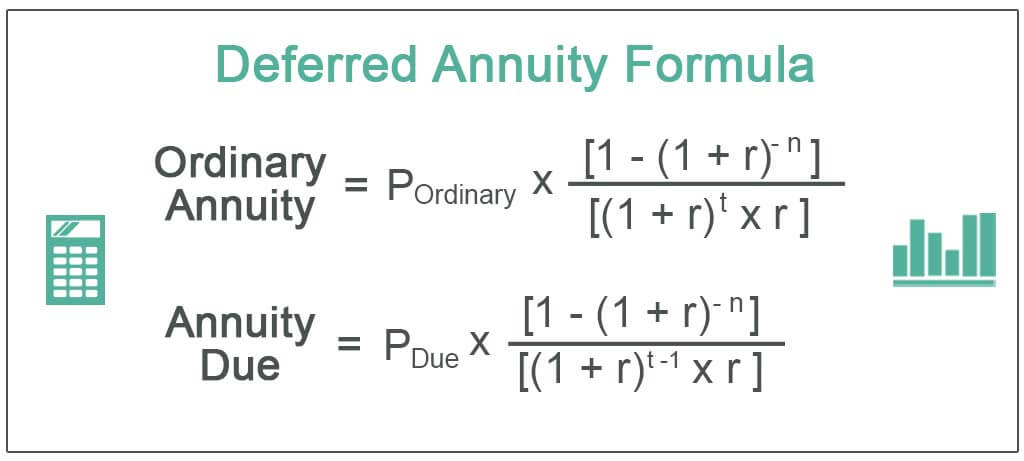

Excel Formula Future Value Of Annuity Exceljet

3 Ways To Calculate Annual Annuity Payments Wikihow

Annuity Contract For Cash Inflows Outflows Example Calculationss

Annuity Contract For Cash Inflows Outflows Example Calculationss

11 3 Present Value Of Annuities Mathematics Libretexts

11 3 Present Value Of Annuities Mathematics Libretexts

Annuity Table Overview Present And Future Values

Excel Formula Present Value Of Annuity Exceljet

Annuity Contract For Cash Inflows Outflows Example Calculationss

Ordinary Annuity Formula Step By Step Calculation

Ca Foundation Maths Busiess Mathematics Time Value Of Money Interest And Annuity Mcq Foundation Maths Time Value Of Money Math Time

Ordinary Annuity Formula Step By Step Calculation

:max_bytes(150000):strip_icc()/FVAnnuityDue-d5efc75568614c3395d63f61357168c0.jpg)

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Comments

Post a Comment